Pro Saving 10/5

A savings plan with worthwhile life coverage for you and your family. Pay for short-term insurance premiums for only 5 years with tax-deductible privileges throughout the contract.

Coverage

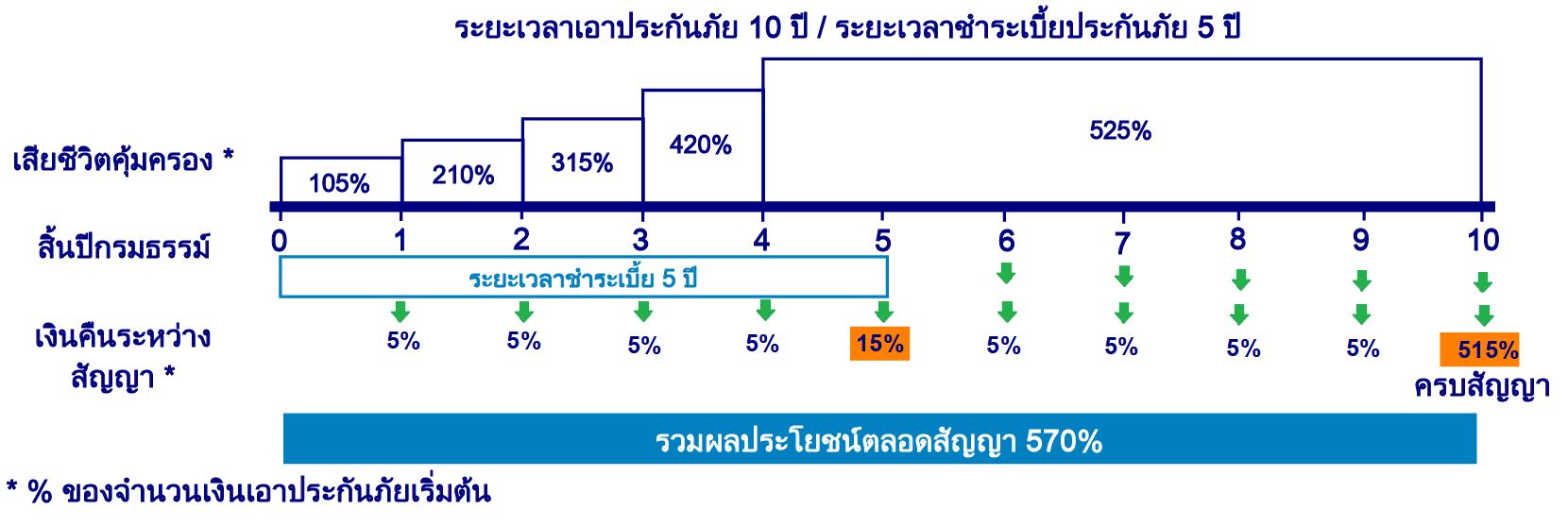

Death coverage 105% - 525% (Depends on the sum assured)

Total benefits

Total benefit throughout the contract up to 570% (Depends on the sum assured)

Tax deduction

tax deductible

Age’s acceptance

1 day - 65 years old

Coverage period

10 years

Premium payment period

5 years

Additional contracts

Not applicable

- Insurance period : 10 years

- Age’s acceptance : 1 day - 65 years old

- Minimum sum assured : 100,000 baht

- Maximum sum assured : 5,000,000 baht

- Additional contracts : Not applicable

- Medical checks : No health check

Remark- The premium of this insurance plan is entitled to personal income tax deduction of not more than 100,000 baht per year (according to the announcement of the Director-General of the Revenue Department on Income Tax No. 172).

- The insured should study more details about coverage, terms, conditions, exclusions, and benefits from the insurance policy.

- Insurance is subject to the company's terms and conditions.

- As for the right to request cancellation of insurance policy (Free look), if the insured verifies the insurance policy and finds that the benefit payment terms or any other conditions are contrary to the intent, misuse, or do not meet the requirements, the insured can cancel the contract by returning the insurance policy to the company within 30 days from the date of receiving an insurance policy from the company. The company will then deduct the cost of issuing the policy in the amount of 500 baht per policy.

Completeness of the insurance contract

In the event that the insured already knows and makes a false statement is already known in any truth but does not disclose that fact to the company, and the company knows the facts, then it may incentivize the company to charge higher premiums or refuse to enter into an insurance contract. This insurance contract will become void under the Civil and Commercial Code, Section 865, in which the company may denounce the insurance contract and shall not pay according to the policy. The company's liability is only the return of all premiums already paid to the company.

In the event that the company’s coverage is ineffective

- The insured voluntarily commits suicide within 1 year from the effective date of coverage under the policy. The company's liability is only the return of all insurance premiums that have been paid to the company.

- The insured is intentionally killed by the beneficiary. The company's liability is only the return of the policy surrender fee to the insured's heirs.

As for the return of insurance premiums or surrender money in the event of suicide or murder, the company has the right to deduct the liabilities bound by this policy.

Remarks

- Insurance will be in accordance with the terms and conditions of the company.

- The insured should study more details about coverage, terms, conditions, exclusions, and benefits from the insurance policy.

- As for the right to cancel the policy (Free look), if the insured examines the insurance policy and finds that the benefit payment terms or any other conditions are contrary to intention, wrongful purpose, or not meet the requirements, the insured can cancel the contract by returning the insurance policy to the company within 15 days from the date of receiving the insurance policy from the company.The company will return the remaining premium after deducting the actual health check-up fee. and the cost of the company is 500 baht each

Caution

The applicant should understand the details of coverage and conditions before deciding to apply for insurance every time. When the insurance policy has been received, please study the details, terms, and conditions of the policy.