Takaful means “Joint Guarantee”

This is a form of assurance accepted by Islam based on mutual collaboration (at-taawun) and donation (at-tabarru) for clarity, honesty, and conformity with Islamic principles.

The operations of Phillip Takaful are deprived of the Islamic prohibitions as detailed below.

1.Deprived of ambiguity and uncertainty (Korlor)

Takaful products are designed on the basis of donation (Tabarru) mutual collaboration between Takaful members who make contributions to the Takaful Fund will be both a helper and a rescuer. If something unexpected happens, in line with the words of Allah in part from Al-Ma'ida (5), verse 2,

وَتَعَاوَنُوا۟ عَلَى ٱلْبِرِّ وَٱلتَّقْوَىٰ ۖ وَلَا تَعَاوَنُوا۟ عَلَى ٱلْإِثْمِ وَٱلْعُدْوَٰنِ ۚ

Meaning “and help one another in virtue and reverence. And do not help one another in sin and enmity.”

Therefore, Takaful contract is deprived of ambiguity and uncertainty unlike life insurance which is a form of contract trading. Such contracts will be bound by uncertainty by receiving compensation or benefits from the company only in the event of a loss.

2.Deprived of betting and gambling (Maysil)

Takaful's operation is deprived of the nature of gambling. The payment of Takaful members' contributions is different from gambling on future losses but in the form of helping a member in trouble. In particular, the company's performance does not depend on how much the Takaful members' claims are made but, on the investment, and profit sharing in accordance with the principles of Mutarah in as the evidence from the Quran forbids Muslims to interfere in gambling in Al-Baqarah (2) verse 219,

۞ يَسْـَٔلُونَكَ عَنِ ٱلْخَمْرِ وَٱلْمَيْسِرِ ۖ قُلْ فِيهِمَآ إِثْمٌ كَبِيرٌ وَمَنَـٰفِعُ لِلنَّاسِ وَإِثْمُهُمَآ أَكْبَرُ مِن نَّفْعِهِمَا ۗ وَيَسْـَٔلُونَكَ مَاذَا يُنفِقُونَ قُلِ ٱلْعَفْوَ ۗ كَذَٰلِكَ يُبَيِّنُ ٱللَّهُ لَكُمُ ٱلْـَٔايَـٰتِ لَعَلَّكُمْ تَتَفَكَّرُونَ.

Meaning “They will ask you about drunkenness and gambling. As such, among them there are many punishments and many blessings upon mankind. But the blame for both of them is greater than yours. And they will ask you what they will donate? Thus, what is left after spending. In that way, Allah will enumerate for you the verses that you will meditate on.”

3.Deprived of interest (Riba)

For the contributions that Takaful members pay into the Takaful system. A portion of it is deposited in an Islamic bank where the return is in the form of a profit margin which is clearly different from the interest rate. Furthermore. Takaful contracts cannot be loaned using Takaful contract as collateral, unlike general life insurance where insurance premiums are deposited in a commercial bank to earn interest; in addition to giving the insured an opportunity to loan money using the policy as collateral by charging interest as determined with the company in accordance with the evidence from the Quran forbidding Muslims to quit interest in the chapter of Al-Baqara (2) verse 278-279,

يَـٰٓأَيُّهَا ٱلَّذِينَ ءَامَنُوا۟ ٱتَّقُوا۟ ٱللَّهَ وَذَرُوا۟ مَا بَقِىَ مِنَ ٱلرِّبَوٰٓا۟ إِن كُنتُم مُّؤْمِنِينَ

فَإِن لَّمْ تَفْعَلُوا۟ فَأْذَنُوا۟ بِحَرْبٍ مِّنَ ٱللَّهِ وَرَسُولِهِۦ ۖ وَإِن تُبْتُمْ فَلَكُمْ رُءُوسُ أَمْوَٰلِكُمْ لَا تَظْلِمُونَ وَلَا تُظْلَمُونَ. (289-287)

Meaning “All the followers! Fear Allah and refrain from the remaining interest. If you are followers and if you do not obey, then know that war from Allah and His Messenger (meaning that Allah and the messenger clearly denounced those dealing with interest) and if you repent, then for you is the cost of your wealth that you will not be unrighteous and unjust.”

4.Deprived of investment that is contrary to Islamic principles

For the management of Takaful Fund, portion of Takaful contributions. The company has properly invested in accordance with Islamic principles in order to generate profits to be allocated to Takaful members based on the criteria for considering the securities to be invested as follows:

Criteria for business operations that operate the following businesses will be excluded from investment consideration.

1) Banks, financial institutions, or insurance that are not operating in accordance with Islamic principles.

2) Alcohol-related business.

3) Swine-related businesses.

4) Entertainment-related businesses such as casinos, gambling, movie theaters, music, pornography, and hotels.

5) Tobacco-related businesses.

6) Weapon-manufacturer-and-distributor-related businesses.

In this regard, the company has set up the Phillips Sariah Board to advise, supervise, and audit the management of Takaful Fund as well as to strictly ensure the correctness of the Takaful business operation according to Islamic principles.

History of Phillip Takaful

Phillip Takaful, formerly known as Finansa Takaful, is a form of insurance that operates properly in accordance with Islamic principles. Finansa Life Insurance Company (in the past) at that time, was the first life insurance company in Thailand to offer Takaful contracts to serve Muslim brothers and sisters who were endorsed by Chula Rajamontri, Mr. Swas Sumalyasak on April 18, 2006 as follows:

This representation is provided to show that “Family Takaful of Finansa Life Insurance Company Limited, which has been approved by the Department of Insurance, Ministry of Commerce. It has been prepared accurately and in accordance with the principles of Islam in all respects.”

Although the Company also operates life insurance business in general, in practice the company operates in the form of "one company, two systems". It is a separation of the "Takaful" work system from normal business operations in which the operation of the Takaful contract will completely separate the income, expenses, and investment accounting systems, including capital from the normal system of the company.

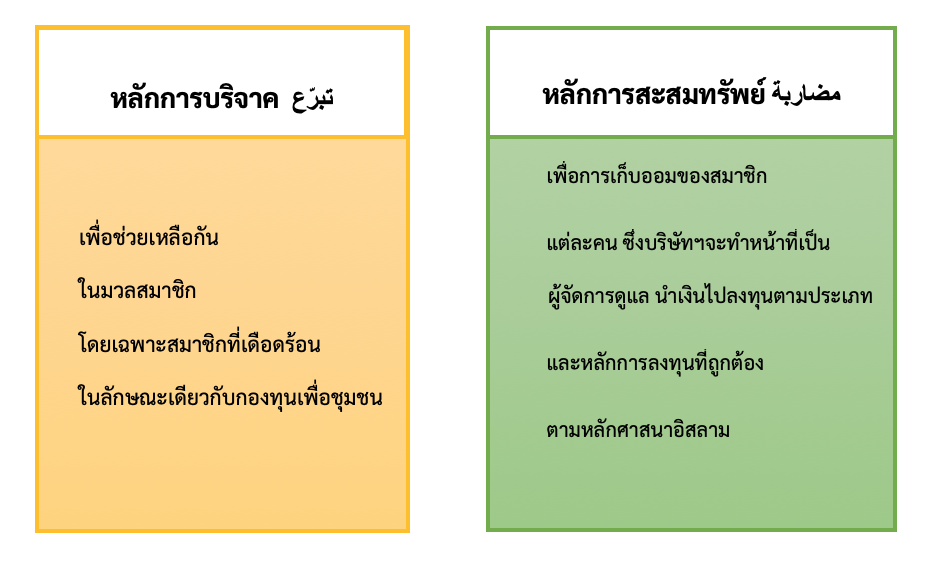

In the design of Takaful products, Phillip Takaful is based on Islamic fundamentals as follows:

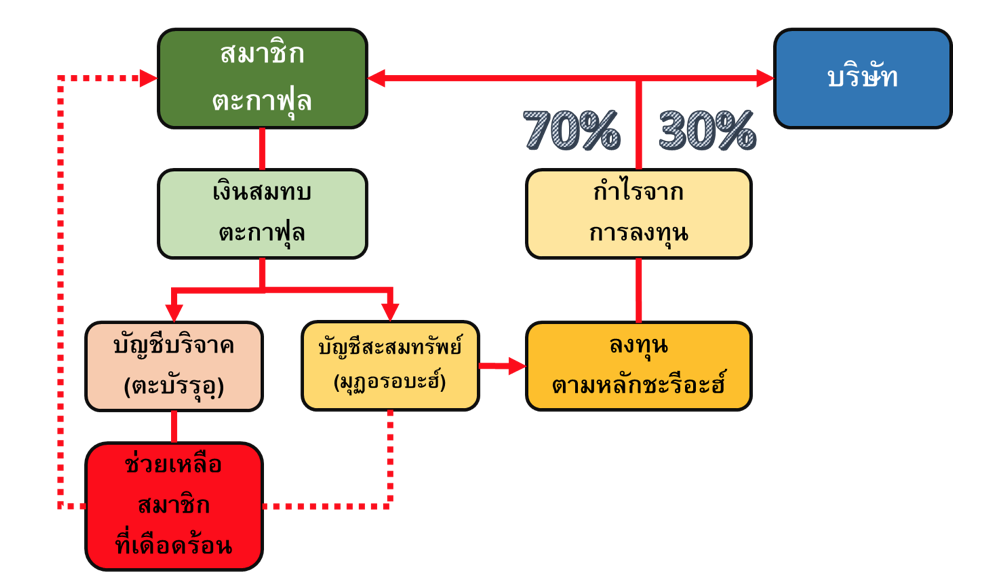

From the above basic principles, it leads to Phillip Takaful's management as shown in below figure.

From the contributions of the Takaful contract received, the company has operated in accordance with Shariah principles. The contribution of Takaful has been segregated on the basis of the principle of donation (Tabarru) and the principle of accumulating wealth (Mudarah) allocated as follows.

Expenses directly incurred from Takaful business will be taken in full, eg. Takaful death compensation and expenses for employees working in Takaful line of business, etc. As for the expenses incurred from Takaful business indirectly, it will be used only for the part of Takaful business, which will be divided into proportion from the total amount of Takaful business to the company's overall business such as office space rental and computer expenses, etc.

As for investments, the company operates in accordance with Shariah principles and is directed by the Board of Directors of Phillip Shariah in accordance with Islamic principles.

The Phillip Shariah Committee, made up of highly qualified and skilled people in both Muslim finance and Islamic practice, supervises the operation and manages the contribution of Takaful received according to Shariah principles under the cooperation of the Islamic Bank of Thailand. This will take care of both saving and investing in accordance with religious principles.

Phillips Life Assurance Public Company Limited has a broad vision and combines the potential, expertise and strength of business partners with the company's commitment to develop products to meet the needs of Thai Muslims. Therefore, we are determined to develop Takaful products especially for Thai Muslim brothers and sisters, which is "Phillip Takaful".

Who do we take care of?

Takaful products were designed and established to respond to the needs of Muslim brothers and sisters in accordance with the Islamic principles of insurance in Thailand by Phillip Life Insurance Public Company Limited. We are committed to provide Takaful products for the general public both Islamic and non-Islamic, including companies or organizations interested in creating insurance for Takaful in order to provide welfare, assistance, and care in case of unexpected events.

Our partners

- MOU with Ibank

- MOU with Islamic Cooperatives

Phillip Shariah Board